Joint Supply: Definition, Examples in Economics, Vs Joint Demand

Here, the average cost per unit is calculated by simply dividing the total cost of all the joint products incurred before their splitting-off, by the total of the number of units produced all together. In conclusion, joint and by-product costing is a crucial aspect of accounting that cannot be overlooked in any manufacturing process. It ensures that costs are appropriately allocated and that accurate financial statements are produced. To ensure compliance with accounting standards, the cost accountant must ensure that the chosen allocation method is disclosed in the financial statements and is consistent with GAAP. The financial statements must accurately reflect the costs incurred in producing joint and by-products and comply with accounting standards. To illustrate this concept, let’s consider the example of a lumber mill that produces two joint products, hardwood and softwood, from a common set of raw materials, such as logs.

Would you prefer to work with a financial professional remotely or in-person?

After the split-off point, the products can be further processed individually. For instance, different products are obtained from milk that, includes cheese, cream, butter, etc. Thus, we see from the above example that White dairy Ltd gets items like butter, cheese, and cream, which have a high and almost equal value in the market, whereas the primary raw material, in this case, is just one, that is milk. However, when the units produced are not measured in like terms, the method cannot be applied.

Get Any Financial Question Answered

However, the Covid-19 pandemic induced fear among the people, adding to a fall in exports. This method is popular due to the argument that a product’s market value reflects the cost incurred to produce it. Under this method, Hassle Corporation designates Product Charlie as a by-product, so it does not share in the allocation of costs. If the company eventually sells any of Product Charlie, it will net the resulting revenues against the costs assigned to Products Alpha and Beta. Joint products can’t be separated until a specific ‘split-off point’ or ‘separation point’.

Compliance Timeline

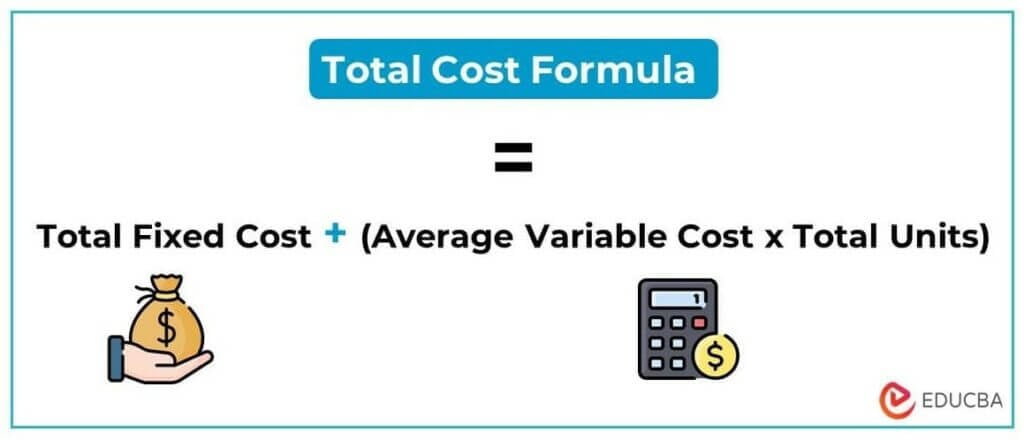

Joint product pricing is crucial for companies involved in multi-product production processes because it affects both profitability and competitive strategy. Efficiently allocating costs and setting prices for each product ensures that no revenue potential is wasted, and each product contributes optimally to the overall profitability of the operation. The total production cost of multiple products involves both the joint cost and individual product costs.

Ask Any Financial Question

The classic example of joint products is found in the meatpacking industry, where various cuts of meat and by-products are processed from one original carcass with one lump sum cost. Hence, the business can’t produce a single product when the process is for the production of a joint product. On the contrary, the co-products can be processed at the will of the business. The joint products are separated from each other once the split-off point is reached in the run of a process. Therefore, the way to allocate the joint cost is based on the respective market values of the items produced. On the other hand, joint products can only be produced together, so adjusting levels of production for a joint product will affect production for the other product.

More advanced methods give weightings to the units based on other criteria such as market value. The method is really a weighted market value basis using the total market or sales value of each unit (quantity sold multiplied by the unit sales price). It is not usually feasible to simply split the expenses down the middle in the case of two products because one product usually sells at a premium to the other.

As long as all units produced are measured in terms of the same unit and do not differ substantially, this method is simple and easy to apply. Given the immateriality of by-product revenues and costs, byproduct accounting tends to be a minor issue. If the estimated profit on sales is 50% on Sugar, 40% on Molasses and 34.27% on Jaggery, apportion the joint cost using reverse cost method.

- You can then multiply this share by the sales value to get the sales value of the project for each product, and use market value allocation methods to split these between them.

- Joint products and by-products have their own cost components, and cost accountants must accurately identify them to allocate costs appropriately.

- Since both products are derived from the same source, it is often difficult to figure out how to divide up expenses.

- She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest.

- An equal split will artificially deflate or inflate profits on one product or the other.

When a venture can appreciate such cost savings, the opportunity is called an economy of scope. However, it will be hard for some products in which the output cannot be measured easily. Some process uses the same raw material but produces the output of a liquid and solid item. All of the output will measure by their physical weight or volume such as tones, kg, liter, and so on. The cost of raw material will be proportion to all products base on each physical output. Joint costs are incurred at the outset, even if each product possesses some value when it emerges from the process.

The cost accountant might use the physical units method to allocate joint costs based on the number of units produced for each joint product. For the by-product, the cost accountant might use the net realizable value method to allocate costs based on the market value of the by-product. Companies that use this method argue that all of the products produced using the same process should receive a proportionate share of the total joint production cost (based on the number of units schedule b form report of tax liability for semiweekly schedule depositors produced). For example, suppose a company produces multiple products from a common set of resources. In that case, the cost accountant might choose the sales value at the split-off method to allocate joint costs based on the relative sales value of each product. The joint products may be defined as two or more different products that are produced simultaneously by processing one or more raw materials through a common production process or a series of production processes.