Is rent expense a period cost or a product cost?

Period costs and product costs are two categories of costs for a company that are incurred in producing and selling their product or service. Kingston, Ont. ranked 17th on the list for highest rents in Canada, with an average rent of $1,966 a month. A one-bedroom apartment costs $1,794 a month, while a two-bedroom apartment rents for an average of $2,145 a month.

Product costs vs period costs: the role in decision-making

In some cases, it will be too expensive for a company to eliminate certain types of period costs from its operations. While direct costs are conveniently traceable per unit, indirect costs is rent a period cost require effort to appropriately allocate across departments, processes, and products. Direct costs like materials and direct labor can be easily traced to individual units of output.

This Smart Security Camera System Will Help You Keep An Eye On Your Home (And It’s On Sale For 62% Off Right Now)

The rent expense is recorded on the income statement each month whether 1,000 units or 10,000 units are manufactured. There is no way to trace the rent cost to specific units of production. To illustrate, assume a company pays its sales manager a fixed salary.

AccountingTools

Remember that retailers, wholesalers, manufacturers, and service organizations all have selling costs. Every cost incurred by a business can be classified as either a period cost or a product cost. A product cost is incurred during the manufacture of a product, while a period cost is usually incurred over a period of time, irrespective of any manufacturing activity. A product cost is initially recorded as inventory, which is stated on the balance sheet. Once the inventory is sold or otherwise disposed of, it is charged to the cost of goods sold on the income statement.

- Period and product costs play different but important roles in financial reporting.

- If the related products are sold at once, then these costs are charged to the cost of goods sold immediately.

- Since they can’t be traced to products and services, we attribute them to the period in which they were incurred.

- Period costs include any costs not related to the manufacture or acquisition of your product.

- A different industry with more manufacturing requirements may require a more complicated calculation.

Product Costs vs Period Costs

Indirect costs like supervision, utilities, and equipment repairs cannot be directly linked to specific units of production. They are allocated using cost drivers like machine hours, square footage, labor hours, etc. Overhead covers indirect production costs like electricity, equipment maintenance, factory supervision, insurance, and more. Overhead cannot be directly linked to individual units and is allocated based on an appropriate cost driver. Freight would be considered a period cost if it is paid to ship the finished product to customers.

Unlike product costs, period costs don’t linger in the inventory valuation storyline. Period costs immediately expense themselves, appearing on the income statement for the specific period they occurred. Unlike product costs, period costs don’t depend on the production volume.

Discover the key to effective financial management with our straightforward guide on variance reporting. Period costs are of no less help, as they allow you to understand how well you’re running your business. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Managers are always on the lookout for ways to reduce costs while trying to improve the overall effectiveness of their operations.

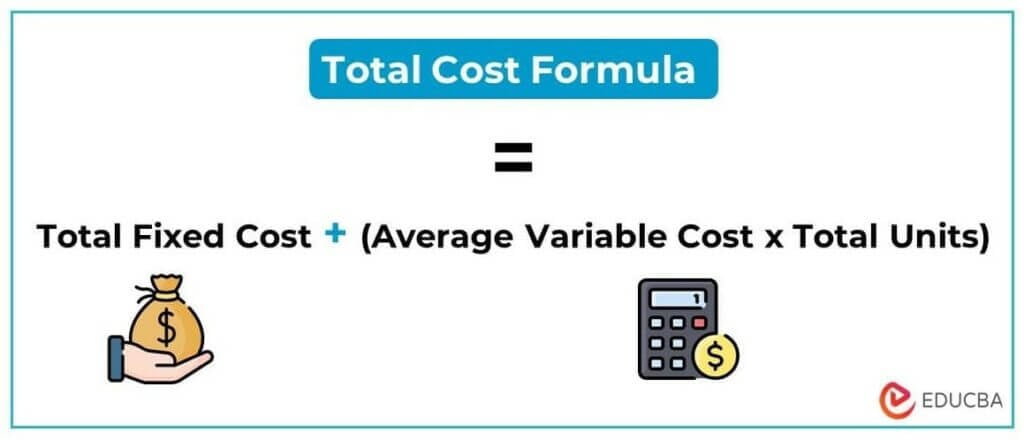

Product costs (direct materials, direct labor and overhead) are not expensed until the item is sold when the product costs are recorded as cost of goods sold. Period costs are selling and administrative expenses, not related to creating a product, that are shown in the income statement in the period in which they are incurred. Period costs are expenses that will be reported on the income statement without ever attaching to products. Since they are not product costs, period costs will not be included in the cost of inventory. Instead, period costs will be referred to as period expenses since they will be reported on the income statement as selling, general and administrative (SG&A) or interest expenses. Product costs include the costs to manufacture products or to purchase products.

The key difference is product costs can be traced to specific units produced, while period costs cannot. Selling expenses are costs incurred to obtain customer orders and get the finished product in the customers’ possession. Advertising, market research, sales salaries and commissions, and delivery and storage of finished goods are selling costs. The costs of delivery and storage of finished goods are selling costs because they are incurred after production has been completed. Therefore, the costs of storing materials are part of manufacturing overhead, whereas the costs of storing finished goods are a part of selling costs.

Rent expense is often a monthly amount paid by a company for use of a building. Typically, the rent is due on the first day of every month that the building is occupied. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.